The versatile chocolate confectionery category covers many different shopping missions – self consumption, sharing and gifting to name a few. Here, Mondelēz International illustrates how independent and symbol retailers can maximise the opportunity in-store.

Confectionery is a growing category1 and it’s a key category for any independent store as it’s purchased on many different shopping missions including impulse, with 33% of shoppers saying confectionery is the reason they are in store2. Confectionery is purchased for both self-consumption and for sharing with families and friends. It also makes a great gift for many occasions and seasonal events, such as Christmas, Easter, Mother’s Day, and Halloween, offering great opportunities for retailers. In fact, 26% of shoppers on a newsagent mission buy confectionery3.

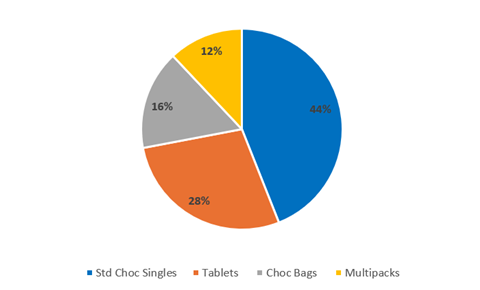

The confectionery market comprises different formats, see below:

Confectionery shoppers drive spend in-store with bigger baskets and longer dwell time4 and the category’s versatility means retailers need to ensure they are making the most all year round. Some simple steps include:

● Ranging the best sellers – when space is tight all products must earn their place in your store.

● Stocking a range of formats – this helps covers all occasions, so be sure to stock singles, duos, multipacks, sharing bags, tablets and sharing gifting products.

● Making it easy for your shopper to find confectionery – the main fixture is absolutely essential to confectionery sales; see our top tips for the perfect display below.

● If appropriate, display confectionery in more than one location* – place confectionery in areas adjacent to other products it’s purchased with to inspire a higher basket spend.

● Making the most of manufacturer investment – promotions, media and new products all help to drive sales, so stock products that are being invested in, as your shoppers will be looking for them in your store.

● Being aware of latest trends – especially in current times, displaying value and offering price marked packs** can help provide reassurance for shoppers. See www.snackdisplay.co.uk for more details.

Top tips

The main confectionery fixture is where the majority of confectionery sales are selected, so make sure it’s easy to shop. Here are Mondelēz International’s top tips:

● The fixture needs to be clean, tidy, and ordered with clear pricing. Consider stocking price marked packs**

● Your range should cover a variety of formats: singles, duos, tablets, bags and gifting and multipacks

● Group product formats together, and group brands together within formats

● Place best sellers in best-selling locations, for guidance and demonstration, visit www.snackdisplay.co.uk

● Double face very top sellers where space allows

● Make the most of manufacturers’ point of sale

● Capitalise on media by highlighting products in store when marketing investment is running.

● Make the most of the seasons

To see some of the above principles put into action, check out the planograms below:

Benefits to retailers

“Snack Display really impressed me. The site contains a wealth of information, which is super simple to access. As a retailer, my time is stretched so I really appreciate a site that can offer me valuable tips to help grow my sales.

“The site has product news, best seller information and product details, including scannable bar codes to help ordering. There are also some great tools on the site including category tutorials, planograms, seasonal advice and planners, as well as links to other useful sites, including Sign Language lessons! In addition, there are downloadable social media images and you can request point-of-sale materials. There’s always a competition for retailers on the site, so it’s well worth checking it regularly and giving them go.”

– Atul Sodha, Londis Harefield

Key products

Please click on the relevant captions for details.

Chocolate singles: Chocolate singles account for 56% of value sales of all singles5 and make up a third of the confectionery market. Singles are highly impulsive6, so consider them as a ‘food to go’ offer and place them as part of your offering near other ‘food to go’ products, as well as on the confectionery fixture*. Chocolate singles’ shoppers tend to be younger and have a higher basket spend, so be sure to stock the latest products.

Chocolate duos: Chocolate duos are in stronger growth than standard singles7, helping drive sales in convenience. The duo shopper is a different shopper to that of a singles confectionery shopper8, with brand as a key driver of purchase in this format. Duos are most often purchased for an on-the-go occasion9.

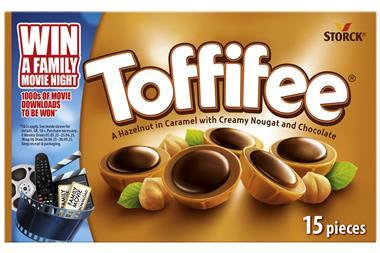

Tablets: Tablets are a really important format; they’re currently growing by 12%10 in indies and symbols and helping to boost overall category growth. The key shopper mission covers ‘night-in’, a sharing occasion where the main purchase motive is a ‘treat’. Value is important in this category, so we recommend stocking price-marked packs** where available, to communicate value to shoppers.

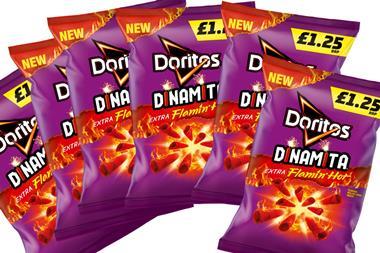

Multipacks: The multipack shopper mission is different to singles11 as most formats are purchased as part of a planned or main shopper mission. Multipacks have been growing in Indies and Symbols12, with taste and value being the most important factors when purchasing13. Separate multipacks from singles on displays, either at the base of the main fixture or a in a designated area.

Gifts and sharing: Gift and sharing lines drive sales value and are a growing opportunity as consumers are increasingly shopping locally. Stocking a strong year-round range to cater for birthdays, ‘thank yous’ and ‘emergency’ purchase gifts is a valuable opportunity for retailers. The seasons are also vital, so retailers should be sure to tap into Christmas, Easter and other annual events.

Where to go

For all ranging and merchandising advice, retailers can visit www.snackdisplay.co.uk.

Sources: 1 Nielsen, Indies & Symbols, Total Confectionery Value Sales, 52 w/e 22.06.24 vs last year. 2 Lumina 2022; 3 Kantar Take Home May 2021; 4 Lumina CTP 2021; 5 Nielsen: Independents and Symbols, 52 Weeks, 07.03.2022; 6 Nielsen: Independents and Symbols, 52 Weeks, 07.03.2022; 7 Nielsen I&S 52 Weeks 7.03.2022; 8 Kantar Take Home May 2021; 9 Kantar Take Home May 2021; 10 Nielsen, I&S 52w, we 15.06.2024; 11 Kantar Take Home May 2021; 12 Nielsen I&S, 07.03.2022; 13 Lumina CTP 2022

* Where stores must comply with HFSS only non -HFSS lines can be displayed in certain area of stores to meet with regulations

** Prices are recommended only. Retailers are free to set their own prices. Non price-marked packs available

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet