Traditional teas still top the charts when it comes to hot beverages, but it’s healthy and premium lines that are showing bags of potential.

Ask any ex-pat what they miss most about the UK and there’s one item that almost always appears in the top three: a proper cup of tea.

Raj Aggarwal, owner of two Spar stores in Leicestershire and Sheffield, says nothing comes close to topping a traditional English breakfast brew. “Traditional English breakfast teas are still well ahead of the rest in our store, without a shadow of a doubt,” he says. “Products such as PG Tips and Tetley teas are just so far ahead of the rest.”

Rebecca Vercoe, Clipper Teas brand controller at Wessanen UK, confirms that traditional tea is still going strong. “Black tea remains the most consumed tea. There is still a place for infusions and green teas, but it’s black teas that are driving category sales in convenience.

“Black tea is a cupboard essential and has a high usage occasion – Brits drink an average of 28 cups a week and many people rely on their local store to top up their tea supplies whenever they run low.”

It’s certainly true at Sandeep Bains’ Simply Fresh store in Faversham, Kent. “One hundred percent traditional teas are still leading the way. We haven’t seen any major growth in terms of sales, but they still certainly are way ahead of the rest. Customers know what they want, they know what they like, and they stick with it.”

For Mandi Duncan, co-owner of two Day-Today stores in Troon, South Ayrshire, the demand for traditional teas comes from the construction workers who frequent her store. “We have a lot of builders using our store, so the basic, traditional teas are the ones that sell the best, for sure. There’s not a lot of point stocking a load of other types of tea when this is the bulk sale of it.”

Mandi continues: “We do stock a few herbal, speciality options for those who want it, but it is the traditional stuff that flies off the shelves.”

And when your store is next to a bus station, it’s no surprise that a big part of your customer base are looking for traditional teas, as Andrea Aston, owner of Save Local in Colchester, Essex, points out: “Bus drivers aren’t coming in looking for speciality teas all that often,” she jokes.

But while traditional English breakfast tea remains a customer favourite, it is the specialist and herbal teas that are increasing in popularity, growing 9.6% year on year in 2016-2017 (The Tea Report 2018), and that growth looks like continuing.

Kim Havelaar, founder of Roqberry herbal infusions and artisan teas, says: “While classics have their time and place, the tea category extends well beyond black tea. Tea blends amazingly well with an exciting range of herbs, spices, fruits and flowers and is still brimming with potential, even though it’s been around for ever.”

Raj agrees that speciality brews are becoming more sought after. “We do sell a lot of speciality teas, but not as much as traditional. But there is a slow increase in sales and they are getting more and more popular.”

He adds: “Herbal teas are getting more popular, perhaps because young people are getting into them more. Fruit teas are showing a slow increase, but the shift is there and people are getting used to them and getting a real taste for them.”

Sandeep says likewise. “The premium stuff is starting to sell well, and we’ve seen a slight increase in sales, but not leaps and bounds as yet. Loose teas such as the ginger, lemon and honey and so on – that is where the category is heading.”

He notes that Millennials in particular are showing a strong interest in speciality teas. “Younger people aren’t just looking for a routine tea, and I can say that because I am one of those people,” he says.

“We’ve had a big move towards Millennials drinking tea. But they aren’t just drinking the normal, plainer teas. I am a Millennial and I find myself going for ginger tea, or peppermint tea – that sort of thing. For Millennials it is less about just drinking it out of habit and more about enjoying one or two cups a week.”

Vercoe believes the Millennials will continue to experiment with new flavours, shaping the category for the future. “The specialist and herbal tea market is growing in popularity, especially with younger consumers who have not grown up with such a strong black tea habit as the older generations.

“Younger consumers tend to have a broader repertoire and are more experimental when it comes to their tea choices. Many seek teas such as Clipper’s Sleep Easy and Detox infusions to help support their well-being, which is a growing area in the tea category.”

She points out that premiumisation is a key trend in the tea category as people are increasingly looking for top-quality teas that can tick all the boxes: “Great taste, ethical sourcing, a strong brand identity and high-quality, natural ingredients”.

Havelaar says retailers should prepare to move away from traditional teas and towards premium, following trends seen in the coffee market. “Coffee has undergone a major evolution and tea is following suit. Sales in premium and speciality tea grow year over year, with standard black tea declining slightly,” she says.

“So while standard black tea will always have a base market, it is giving way to more novel speciality black tea varieties, green tea and herbal infusions. Premium ingredients provide a higher quality of flavour.”

Clipper creates plastic-free tea bags

Clipper Teas, the ethical tea brand owned by Wessanen UK, claims it has developed the world’s first plastic-free, non-genetically modified and unbleached heat-sealed tea bag.

The new tea bags are made from a natural plant-based material: a blend of abaca (a species of banana); plant cellulose fibres; and PLA (a bio-polymer derived from non-GM plant material that helps hold the paper together).

This latest innovation from Clipper is driven by brand owner Wessanen UK’s wider mission to minimise the company’s impact on the environment and the natural world.

Wessanen UK ceo Emma Vass says: “We believe in making ethical and sustainable choices and want to provide the best products for both our consumers and the world we live in. Having worked tirelessly to find a natural, non-GM solution, it is fantastic to see the new tea bags now in full production.

“As a brand, Clipper is all about the joy that comes with each and every cup of tea – and we believe the purest joy comes with a clear conscience.”

Coffee

Tea may be the nation’s favourite hot beverage, taking almost half volume share (45.1%) compared with coffee at 30.5% (KWP Usage Study year to 12 August 2018), but it is coffee that’s the number one hot beverage at Andrea’s Save Local store. “Plain old coffee is a front runner for our store. Most of our customers cannot look past the likes of Costa – the machine or packaged.”

Jeff Beedie, head of category and channel development at Lavazza, highlights the importance of coffee, a category worth £1.07bn to UK retailers (Nielsen 2018).

In 2018 Lavazza saw a 21.6% rise in convenience sector sales (Nielsen 2018), with its instant coffee growing 246.4% in convenience.

“When it comes to coffee, instant takes up the majority of total sales in convenience, but independent retailers should still offer a wide roast and ground selection,” Beedie says.

He adds: “Premiumisation is a key market trend in the hot beverages sector, with shoppers such as Millennials looking for quality products and the desire to replicate their high-street experience at home.

“Products that are able to offer these qualities are a constant best-seller within the convenience market, where instant represents 75% of total coffee sales (Nielsen 2018).”

When it comes to merchandising strategies, Beedie advises retailers to merchandise according to format (instant, ground, capsules) and then by brand.

“Look at promoting by occasion, and use promotional displays with multiple product categories. These can be either single price-downs across the range or a link save for multiple products,” he says.

Sandeep says Lavazza does well in his store. “Lavazza sells really well for us. I think that people just recognise the brand, know what they’re going to get and enjoy it. We’ve recently introduced the new Co-op pod coffee range which seems to sell well, too.”

Nescafé claims the top spot at Raj’s stores. “In terms of top sellers across all our hot packaged beverages, Nescafé in 100g, Gold Blend 100g are up there. They sell better than anything else we have.”

But Raj has noticed a shift in buying as shoppers increasingly turn to decaf. “People are switching up their ways and getting more decaf options nowadays. Perhaps it’s for health-conscious reasons, but for whatever reason it is happening.”

Tata Global Beverages director of customer and shopper marketing Peter Dries believes that the hot beverages category has been seeing a shift towards health and decaf variants for some time now, and warns of the risk of not stocking them.

“Tea shoppers are often looking for something a little bit different, whether a different taste experience or products that meet their desire for health, and this is reflected in sales. Value sales are up across the board in impulse for products that fit the bill: decaf (0.1%); fruit and herbal (8.8%); green (10.6%) and Redbush (9%).

“Evolving lifestyles and continued interest in health has created space for new products offering different taste experiences to shoppers and bringing higher value sales to retailers.

“With more shoppers wanting to take the additional vitamins they need through their diet, functional food and drink with added vitamins has become a major trend which has created opportunities to increase sales across a number of areas.”

He adds that decaf drinkers won’t choose an alternative, so if one isn’t available, a sale won’t be made.

It isn’t just health-conscious consumers that retailers may need to consider, as the move to plastic reduction continues to gain pace.

Campaign group A Plastic Planet has called for a transformation of the UK’s approach to waste management. Co-founder Sian Sutherland highlights the important role the convenience sector can play.

“Environmental factors are having a far greater impact on the convenience sector now that people are aware of the impact it has on our planet. Factors such as plastic pollution are making organisations in the packaged hot beverages category re-think their approach,” she says.

“As a result of sustained public pressure, more companies are looking at how they can make their products sustainable and it is the businesses that do not do this who will be left behind. Brands such as Teapigs and Percol are leading the way forward by supplying plastic-free packaging and plastic-free tea bags.”

Havelaar adds: “Sustainability is important and there is increased consumer awareness about this. Most standard tea bags contain plastic which is added during the sealing process and definitely is not great for the environment. Luckily, the better pyramid tea bags on the market now are not only plastic-free, but biodegradable.”

Vercoe agrees that brands that are seen as better for the environment will be the winners. “With the rising interest in well-being, both personally and for the planet, consumers are looking for hot beverages made with natural, quality ingredients, which is where brands with organic principles such as Clipper will grow.

“At Clipper, we’re fiercely committed to minimising our environmental impact, which is why we’ve recently launched the world’s first heat-sealed tea bag made from natural, plant-based materials that’s not only non-GM and unbleached but is also plastic-free.”

Instant standout for Little’s

Little’s has unveiled a new look for its flavoured instant coffee range, along with new fully recyclable packaging.

The company says it is the first instant coffee brand in the UK to go completely plastic-free, thanks to its new aluminium lids and 50g glass jars (rrp £2.99/25 servings per jar).

Little’s co-founder Will Little says : “Our flavoured instant coffee is made using smooth, 100% Arabica beans, gently infused with high-quality flavours from ingredients we love. We’ve spent decades perfecting our flavoured coffee recipes to ensure they deliver on taste and so wanted our branding to more effectively communicate the premium and innovative nature of our products.

“Creatively we wanted to own a unique and attention-grabbing visual within the coffee category and inject our personality into what’s predominantly a very traditional space.

“We’ve used strong, classic typography and assigned a pattern and a simple colour palette to each flavour to achieve this, and bring differentiation between our products.”

Little’s Coffee is made using 100% Arabica beans and comes in 13 flavours: French vanilla; rich hazelnut; chocolate caramel; island coconut; Irish cream; gingerbread cookie; café amaretto; chocolate chai; Swiss chocolate; maple walnut; Havana rum; chocolate orange; and cardamom bun.

Hot chocolate

Another hot beverage hit is hot chocolate. “Hot chocolate is and always will be a customer favourite,” says Raj.

“Cadbury is a hands-down clear favourite for our customers. Aero hot chocolate products are a close second, but Cadbury is definitely top. Hot chocolate in general is just a very sought-after product.”

Mondelez International trade communications manager Susan Nash adds: “Mondelez International is the category leader in the chocolate beverage market, which is worth more than £82m in the UK – it is the number one manufacturer and Cadbury is the number one brand.

“Within the market, Cadbury offers an extensive range – leading the drinking chocolate, instant chocolate and cocoa sub-categories. The brand’s largest share is within the drinking chocolate segment, where Cadbury holds a 70.5% stake, with growth that is leading the category at 4.5% (category growth 2.5%).

“As the market leader, Mondelez will continue to invest in the category in 2019 in order to drive growth and future proof the category, increasing marketing investment by 56%, with campaigns that focus on out of home and digital media.”

For Mandi, the Millennial generation are pushing sales of hot beverages, with hot chocolate topping their shopping list. “We have seen a significant rise in the number of Millennials and younger people buying packaged hot drinks recently,” she says.

“Even from right down at school age they are buying it, which is a complete change from the past two or so years. They certainly wouldn’t have done that before. They are drinking mainly hot chocolate and coffee, which I find surprising.”

According to Mars Chocolate Drinks & Treats (MCD&T), UK households purchased nearly 62 million variants of hot chocolate from January to October 2018, accounting for 89% of value sales, with hot chocolate representing 69% of the food beverage category.

MCD&T general manager Michelle Frost says: “Our love affair with hot chocolate continues. Combining strong brands with exciting and innovative products has seen our hot chocolate range continue to grow.

“The range now includes options for those seeking traditional, instant, malted, low calorie or indulgent hot chocolate in a variety of different formats.”

So whether your shoppers prefer their hot drink decadently chocolately, caffeine-free and full of natural goodness, or strong enough to stand a teaspoon up in, bear in mind that there’s a big thirst for speciality, indulgent and premium lines, alongside the traditional favourites.

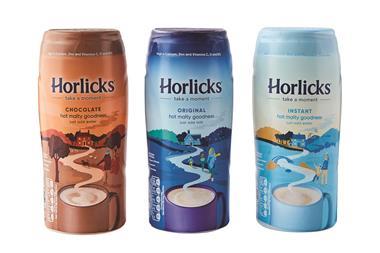

Horlicks goes lighter

Horlicks has introduced a new and improved Instant Light Chocolate, available in both sachet and jar formats.

The malt drink (rrp £3.50 per 500g jar/30p per 32g sachet) is now made using 6.6% fat reduced cocoa powder and 13% malted barley, with less sugar, salt and calories than its predecessor.

Aimia Foods marketing manager Michelle Younger says: “We are keen to reward our loyal consumers with a more indulgent experience, building on our unique malty taste heritage and with greater appeal to chocolate lovers, which the new formula represents.

“The combination of the increased cocoa and malted barley content has had a very favourable response in testing and we are excited to gauge the consumer reaction.

“We are also expecting incremental sales from regular hot chocolate consumers – particularly from those families with children who are keen to explore healthier alternatives, and from the more health-conscious demographic.”

She adds: “We will be investing heavily in the new improved Horlicks Instant Light Chocolate launch as part of our integrated marketing strategy for the brand which will continue into 2019 with a £1m marketing spend forecast.”

The new improved product contains 14 vitamins and minerals, including calcium, vitamin D and vitamins A and C (when prepared using instructions) and is available to retailers now.

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet