With the festive season approaching, consumers will be looking to maximise the time they spend with family and friends, and the convenience and ease offered by the frozen category can free up their time even more, says Birds Eye.

The upcoming festive season holds high expectations, with people looking to make up for lost time with loved ones after last year’s lockdown restrictions. The frozen category is set to present a great opportunity to drive sales for retailers over the seasonal period, with frozen food offering greater convenience to shoppers, as they seek more time spent with family and friends, while still enjoying a tasty and hearty Christmas dinner.

Why frozen?

With 40% of shoppers more likely to buy frozen food now compared to pre-pandemic1, the category has opened up new seasonal sales opportunities for retailers to capitalise on. Frozen food offers both retailers and shoppers a number of benefits over their fresh and chilled equivalents, notably its longer shelf life, the retention of nutrients and ‘freshness’ that the freezing process allows, and its overall convenience. Frozen food adds that extra helping hand to the Christmas meal preparations as shoppers can spend less time cooking and more time with their family during a period when quality time spent together is valued.

Meeting shopper demand

Roast dinners have long been a staple meal during the winter months, and they are also a frequent meal choice in many Christmas celebrations. Over the course of the pandemic, many shoppers turned to the convenience channel for their ‘big shop’, so larger convenience stores should offer a wide range of roast dinner products, from the core favourites such as roast potatoes and Yorkshire puddings, to other classic items such as parsnips. Smaller stores looking to capitalise on demand should focus on those all-important roast dinner essentials, in order to appeal to top-up and last-minute shoppers.

For retailers looking to stock-up on multiple products to maximise their Christmas dinner sales, it’s worth turning to established brands, which can offer the core staples that shoppers will be looking for. Aunt Bessie’s has become synonymous with the roast dinner occasion, after generations of helping families to create the perfect roast dinner. In fact, 22% of roast dinner shoppers only buy into Aunt Bessie’s2, demonstrating the importance of stocking well-known brands to attract them. Aunt Bessie’s shoppers also spend more per trip on this brand than competitor shoppers2, making it a must-stock brand for retailers looking to maximise their Christmas dinner sales.

When to start

December is the most important retail month in the run-up to Christmas, with shoppers seeking their festive dinner essentials – in fact, during December 2020, 1.2m Yorkshire Pudding shoppers only purchased the item that month3.

To drive sales in the build-up to the big day, retailers should start stocking relevant Christmas dinner products from the start of December, drawing attention to their frozen range through in-store POS where possible. A benefit of frozen is that many of these products will be relevant all year around too, and not just for Christmas, helping retailers to attract roast dinner shoppers at other key seasonal occasions such as Easter, as well as for regular Sunday roasts.

Top products to add to your range

● Aunt Bessie’s Yorkshire Puddings: Aunt Bessie’s Yorkshire Puddings were the top-selling product across the entire frozen category in December last year4.

● Aunt Bessie’s Roast Potatoes: The number of consumers who will only purchase Aunt Bessie’s Roast Potatoes is almost double that of its main competitor in the roast sub-category5. Aunt Bessie’s was also recently voted Good Housekeeping’s best ready-made roast potato of 2021 with its new and improved Roasties recipe

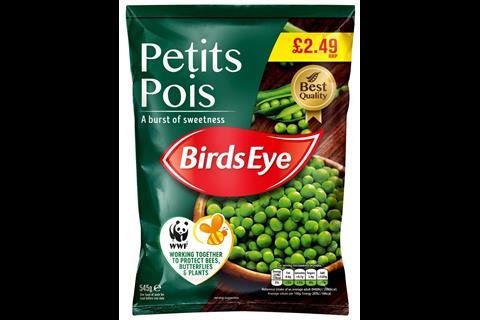

● Birds Eye Petits Pois: Available in price-marked pack format, this product offers shoppers a quick and easy solution for bringing multiple vegetables into a meal.

For more details on how Birds Eye’s products can help you boost your frozen food sales, click here.

Sources

1 Censuswide study of 2,023 parents between 16.07.2021 - 21.07.2021. Censuswide abides by and employs members of the Market Research Society which is based on the ESOMAR principles

2-5 Kantar & Nielsen, Christmas 2020 review across data periods 4/we 27.12.2020, 26.12.2020, 29.12.20