The latest analysis from Circana examines crisps, nuts and snacks in convenience in terms of value sales and market share

Total outlet sales in the impulse sector were up 9.7% in the L4W vs LY, but only up 8.4% in Symbols and Independents versus last year as confectionery volume shifted to supermarkets for Halloween.

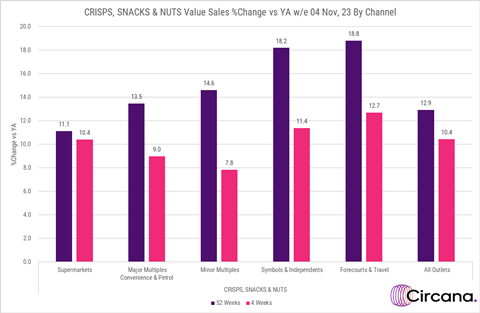

This seasonal shift means that the crisps snacks and nuts category was up 10.4% in all outlets in the last four weeks compared to 12.9% in the last year.

Crisps, snacks and nuts growth is slowing across all channels, as price inflation laps with last year, but growth is slowing more sharply in symbols and independents, with the growth over the four-week period at 11.4% versus the 52-week growth of 18.1%.

In supermarkets, the slowdown in growth is much less marked, moving from 11.1% in the 52-week period to 10.4% in the last four weeks.

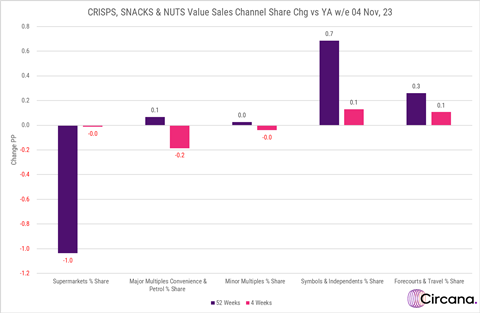

As a result, whilst Symbols and Independents grew value share of the crisps snacks and nuts market over the year, the gain over the four weeks was just 0.1PP, a stark growth share slowdown versus the 52W position of +0.7PPs versus last year.

While showing a decline, supermarkets have been the big share winners, with share slightly down in the L4W, while over 52W Supermarkets were down -1.0PP versus last year.

What’s next in crisps, nuts and snacks?

Party season is almost upon us, with Christmas typically being a strong period for crisps, nuts and snacks sales. With consumers watching the pounds (money not weight), the big night in is also going to be a big opportunity for category sales during the winter months. The Office of National Statistics reported that prices of crisps fell 3.4% between September and October this year, compared with a rise of 4.1% between the same two months a year ago, so while the value of the category may dip, consumers will hopefully start seeing more value when shopping for their snacking goods.

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet