The latest analysis from Circana examines the petcare category in convenience in terms of value sales and market share

Sadly, the UK petcare market is continuing to struggle, with value sales are down -4.1% in the latest 52 weeks (L52W) versus (vs) last year (LY). There is little evidence that the market performance is turning around either - with value sales down -5.3% in the L13W vs LY. Decline is being driven by units and despite a small trend improvement on the 52W year-on-year (YOY) performance (-4.6%), units remain down by -3.0% in the L13W vs LY.

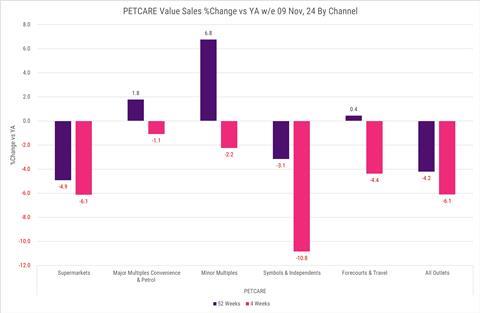

What we’re seeing is a decline despite significant promotional investment from branded manufacturers, with an 8.7 percentage point (PP) increase in % units sold on promotion in the L52W vs LY. This investment has helped brands win share from private labels but it has failed to grow the market which has suffered from the impact of the cost-of-living crisis post the pandemic peak. Counter-intuitively given the promotional investment in the Major Multiple Grocer Supermarket channel, the Symbols and Independent Channel has performed relatively well in comparison, with a 52W -3.1% sales value decline on LY versus a -4.9% value sales decline vs LY in Major Multiple Grocer supermarkets.

As a result, the Symbols and Independent channel has gained a small amount of market value share in the L52W vs LY, with value share standing at 7.5PP for the L52W. As such, Symbols and Independents do have a significant under-trade in Petcare compared to their share of food, which a represents an opportunity albeit in a declining market. The recent performance of Symbols and Independents sees the channel lose -0.4PP of share in the L4W vs LY which means the trend significantly worsened vs the 52W performance, whereas in food there was a slight improvement in the performance trend as a result of year-on-year weather patterns boosting convenience.

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet