Daniel Wilson and brother Craig have been galloping down the acquisition trail in recent years, with 19 One Stop stores in their portfolio and reaching an impressive £25m turnover.

But with costs rising, Daniel is adjusting his focus to ensure that Wilson Retail remains a well-oiled machine, running with maximum efficiency.

“We probably will still do [new] stores, but I don’t see it being so dramatic,” he says. “It is a little bit hard on the market, it’s not as easy. There’s not as much growth as there was and because costs have risen so much, it does make your break evens and your losses early on much higher.

“We’ve got stores that trade decently, but still don’t make money. And they probably would have done a year-and-a-half ago, just because the electric bills are three to four grand a month and wages get higher. Whereas it might have taken between six and 12 months for a store to be making money, now it could be 12-18, though obviously it depends on the store.”

Within the Wilson Retail estate, Daniel claims that two of his stores have yet to make profit. “It’s all a bit seasonal, so it can jump up and down a little bit, but overall, I’d probably say we have two stores [that aren’t making money] and maybe a third very close that’s just breaking even,” he says.

“We’ve got some good ones that we’ve opened recently, that straight away [make money], but with some of the others … the growth’s gone a little bit, so they aren’t growing as fast, but they will do – another year down the road for all those stores will probably be quite significant.”

He claims that this isn’t an unexpected situation. “It’s not unusual for us - many of our stores took quite a while to grow and some are still growing consistently now, so we’re used to it. We know there’s a pattern that will come and most of them do continue to grow, especially the first three years.”

However, rising business costs are creating challenges. “The thing that’s just hit it, that makes it more difficult, is the cost,” he explains.

“Whereas a few years ago, you might have lost a smaller amount, now you can lose quite a lot, especially when we’ve been caught with some higher energy rates. The problem is we signed two year contracts because we got cheaper rates then, but now the prices have come down, so we’re still stuck on those rates until August next year.”

Nevertheless, he is optimistic. “I wouldn’t say it’s necessarily tough,” he says. “I’d say it’s tougher. There’s still good opportunity and we’re still doing very well, so I can’t complain. To be honest, even the shops that aren’t performing as well, they’re only probably performing to expectations. It’s more the costs, rather than the actual trade.”

So rather than growing his estate, Daniel is focused on making savings. “I really want the shops trading as much as they can and to push them,” he says. “I think we’re good at that, but we do lose a little bit of focus when you’re doing new ones. So I think that’s probably what we’ll get back into a little bit more.

“We could do with catching up on that [efficiency] and letting some of the stores grow so that they’re maximising the sales,” he says. “It’s almost allowing them to catch up and then build more, which then obviously gives us more money for the business.”

He acknowledges that borrowing funds is also an option, but it is not always a good solution, he says. “You want to borrow at times because you’ll need to and certain opportunities come up, but sometimes it’s also wise to sit back and recoup and use as much of your own money as you can. And that’s what we try and do … and quite often we’ll reinvest profits and stuff like that. But I’m an accountant … I’m always quite cautious and also we constantly keep trying to refit our shops and keep trying to improve them as well. But we’ve always got to keep that in the back of our minds.”

He is mindful that business rate relief won’t last forever at its current level. “There is business rate relief that they give out at the moment, which is quite high for retail. That’s one of the aspects you’ve got to be careful of. I would imagine they’ll continue a lot of that … but the risk is if they don’t, you don’t want to put yourself in a position where you borrowed yourself to the hilt and where you actually overstretch yourself and then new costs come in.

“It’s about expanding, but trying to be balanced.

“There is always a temptation [to buy new stores], it’s sometimes hard to hold back because people offer us a lot of stuff nowadays,” he says. “We turn loads down, we’re very selective about what we pick. But if something really good comes up, I probably would take it, I could finance it. But we’re deliberately trying not to look at the minute.”

Instead, Daniel is turning his attentions to where he can make savings in order to keep costs to a minimum. “We’re going through waste a lot at the minute,” he says. “One Stop has a system out called WhyWaste [now Invafresh].”

Daniel is referring to Invafresh’s Fresh Retail Platform, which uses an AI-powered algorithm to create optimal discounts on soon-to-expire products, ensuring maximum profitability. “When you sell your stuff reduced, it keeps recording it and then it knows your sales,” says Daniel. “So the idea is, if you’re reducing something often that doesn’t sell much, it’ll probably make it very cheap. Whereas, if it’s something doesn’t get reduced very often and it’s got very good sales, it [the system] won’t reduce it by much because it knows it’ll probably sell.”

The stores have also undergone range optimisation with both Daniel and One Stop making changes. “One Stop took out some bad selling lines that we’d have probably taken out anyway,” says Daniel.

In October, the franchise group announced the introduction of 108 new lines to its fresh range, as well as the removal of 50 lines that were underperforming.

In addition, Daniel has been making further alterations, delisting lines that are regularly reduced and taking the time to thoroughly analyse orders and reports.

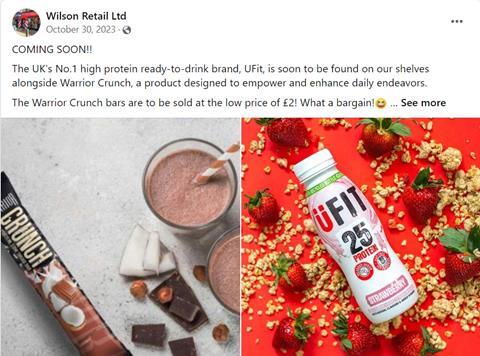

He has opted to make more room for protein drinks, such as Ufit and Huel, in his stores.

“There’s good margin [on protein drinks]. People are much more into health things, so they’re in demand a lot,” he says. “And also, the good thing is they are long life. We’ll test them out, we might not get sales in certain products, but something that’s long life doesn’t incur so much waste.”

For stores that have slightly lower chilled sales, he’s taken a few more of those lines out and added in more protein products.

“If you’ve got slow moving stuff, but it’s only got a week’s date, it can cost you money, whereas if you’ve got slow moving stuff and it’s got 10 months, it doesn’t really cost you money for it. It’s looking at that and judging each shop,” he explains.

So far, the waste savings have made a significant impact. “With all the changes, we’ve probably cut the waste by about a grand to a grand-and-a-half [a week] across all the shops. Whether we can maintain that, I don’t know. But obviously, you’re talking 50-75 grand for that many stores a year extra in savings, if we continue to do that.

“We might not be able to keep it up at £1,500, but I think we’ll keep it at £1,000, so that’s around £50,000 extra across all shops.”

As well as reducing food waste, Daniel believes his newly added lines will add incremental sales. “Also, I think there’s some extra sales to come in some of the stuff that we’re bringing in … products that I think One Stop aren’t as quick on like protein shakes.

“That’s that’s one of one of our things we’ve had a chance to focus on now and hopefully it makes a bit of difference. It’s a little bit more work for us and we’ll be ordering some lines outside of One Stop, but it all adds on to profitability.”

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet