You might have thought that the term ‘spring clean’ was more of a phrase than an actual occasion, but not according to household cleaning expert Reckitt Benckiser (RB). The company behind household names such as Dettol, Cillit Bang, Harpic and Mr Sheen says that 53% of UK women are ‘true’ spring cleaners. And as such, RB reckons that the ‘spring clean’ period of February to May provides a great opportunity for sales of household cleaning products.

The company’s marketing director for UK household and personal care, Phil Thomas, comments: “Retailers need to be prepared to make the most of this opportunity. That means taking time to review their product offer and ensuring that products are conveniently and prominently displayed in store.” In the current economic climate, consumers will obviously be looking for value, so RB says it will be running sector-specific promotions aimed at driving both brand and category growth. Its promotional activity specifically designed for the convenience sector is primarily based on keen pricing/extra-fill and value. Examples already confirmed are: Finish ‘All in 1’ 14s in a £2.99 pricemarked pack and Finish ‘Max in 1’ 14s in a £1.85 pricemarked pack.

Says Thomas: “These examples allow convenience store retailers to offer pack sizes to meet the needs of consumers at strong competitive prices. In addition, all of the ‘must have’ lines listed above are included in promotional plans for all of our cash and carry customers.” He adds that RB will not be cutting back its activity in 2009. “Not only will we continue to innovate with a regular flow of new products but, most importantly, we will continue to heavily support our brands both above and below the line, committing a higher percentage of our revenue back into marketing than any other FMCG company,” he explains. “In many household categories we are seeing markets contract as consumers tighten their spending and seek out deals. However, so far we are seeing brands’ shares remain very resilient and there is little trading down to private labels in most household categories. “Given the current economic situation consumers are more likely to move towards multi-function products, but only if they deliver equally effective results across a range of cleaning tasks.” These days most companies have ethical issues on their agendas and RB is no different. As part of its environmental programme, this year will see the rollout of a major new consumer initiative – Our Home, Our Planet. This takes the form of pack-based information designed to help consumers use the products and eventually dispose of the packaging in the most environmentally responsible and cost-effective way.

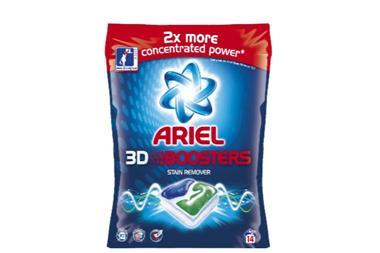

Says Thomas: “If everyone followed the ‘smart usage’ guidelines on our Finish packaging it would save about 1.28bn kilowatt hours of electricity per year – the equivalent of taking 175,000 cars off the road. At the same time, of course, their electricity and water consumption – and bills – would reduce. In this way we’ll help consumers get both the performance and value they are looking for from our products, while still minimising their impact on the environment.” Sticking with the environment, but moving onto the laundry category, Procter & Gamble (P&G) reports that its ‘Turn to 30’ campaign – which encourages people to turn their washing machines down to 30°C – has been a great success. The company reckons that 17% of the country now turns down the temperature of their wash compared with 4% prior to the campaign. However, its latest launch – Ariel Excel Gel – encourages consumers to turn their machines down to 15°C or, if machines don’t go that low, to a cool setting. The product is described as “a breakthrough, new-generation of washing detergent, which delivers outstanding cleaning even at temperatures as low as 15°C”.

Brand public relations manager for fabric and home care at P&G, Catherine Fairchild, says: “Our surveys of consumer habits and practices confirm people are washing at lower temperatures, and they are definitely becoming more aware of the energy they use in their homes. They understand that by turning the temperature down on their wash, they are positively impacting the environment, but also their energy bill. Lots of UK consumers have become more energy-conscious as a result of the Ariel campaigns and the work P&G has done with our external partners such as the Energy Saving Trust.” Meanwhile, Unilever laundry category manager Marie Scoble says last year was a good one for laundry with sales up 2.7% to just shy of £1.3bn, according to IRI figures for the 52 weeks ending November 30. It was an even better period for Unilever, whose Surf brand enjoyed growth of 27%. Scoble says Surf is particularly relevant for c-stores as it’s a value brand that offers users fantastic cleaning and fragrance. “Fragrance is a really big trend. A lot of consumers will think ‘all washing powders clean so I want one with a really nice fragrance’ which is why so many pick Surf,” she explains. In washing, ‘powders’ format is important. Actual powder is still most popular, accounting for 40% of sales; followed by tablets with 22%; liquids with 21%; and capsules accounting for 17% of sales. Scoble reports that concentrated liquid is the fastest-growing format and that’s good news for c-store retailers as packs take up less room on shelf. She says pack size is important as many c-store customers will be walking to and from the shop and won’t be able to carry large and heavy packs of powders and liquids. “Shoppers are most loyal to format first then brand,” she says. “Next is variant, which is why we suggest that retailers merchandise their shelves in this way. They need to stock the brands their customers want and they need to offer bio, non-bio and colour variants.”

She adds that people are shopping around more for deals and promotions: “Promotions are definitely relevant for c-stores and a single unit price is the preferred mechanic. Pricemarked packs are popular, too, for showing consumers that stores offer value.”

wash and grow

As well as washing powders the laundry category includes products such as fabric conditioners,

pre-washing treatments, ironing water and tumble dryer sheets. Scoble says: "Each retailer knows their catchment and will know what will sell in their store."

Finally, one product that's catching on fast with consumers is Colour Catcher, which aims to prevent colours running in your washing machine. Instead of colours from different clothes running into each other they are caught on the Colour Catcher sheet.

The product comes in a trial pack of five sheets for 99p, as well as 10s packs for £1.99 and 20s for £2.99.

Colour Catcher will be promoted in 2009 by sampling and money-off coupons.

The company’s marketing director for UK household and personal care, Phil Thomas, comments: “Retailers need to be prepared to make the most of this opportunity. That means taking time to review their product offer and ensuring that products are conveniently and prominently displayed in store.” In the current economic climate, consumers will obviously be looking for value, so RB says it will be running sector-specific promotions aimed at driving both brand and category growth. Its promotional activity specifically designed for the convenience sector is primarily based on keen pricing/extra-fill and value. Examples already confirmed are: Finish ‘All in 1’ 14s in a £2.99 pricemarked pack and Finish ‘Max in 1’ 14s in a £1.85 pricemarked pack.

Says Thomas: “These examples allow convenience store retailers to offer pack sizes to meet the needs of consumers at strong competitive prices. In addition, all of the ‘must have’ lines listed above are included in promotional plans for all of our cash and carry customers.” He adds that RB will not be cutting back its activity in 2009. “Not only will we continue to innovate with a regular flow of new products but, most importantly, we will continue to heavily support our brands both above and below the line, committing a higher percentage of our revenue back into marketing than any other FMCG company,” he explains. “In many household categories we are seeing markets contract as consumers tighten their spending and seek out deals. However, so far we are seeing brands’ shares remain very resilient and there is little trading down to private labels in most household categories. “Given the current economic situation consumers are more likely to move towards multi-function products, but only if they deliver equally effective results across a range of cleaning tasks.” These days most companies have ethical issues on their agendas and RB is no different. As part of its environmental programme, this year will see the rollout of a major new consumer initiative – Our Home, Our Planet. This takes the form of pack-based information designed to help consumers use the products and eventually dispose of the packaging in the most environmentally responsible and cost-effective way.

Says Thomas: “If everyone followed the ‘smart usage’ guidelines on our Finish packaging it would save about 1.28bn kilowatt hours of electricity per year – the equivalent of taking 175,000 cars off the road. At the same time, of course, their electricity and water consumption – and bills – would reduce. In this way we’ll help consumers get both the performance and value they are looking for from our products, while still minimising their impact on the environment.” Sticking with the environment, but moving onto the laundry category, Procter & Gamble (P&G) reports that its ‘Turn to 30’ campaign – which encourages people to turn their washing machines down to 30°C – has been a great success. The company reckons that 17% of the country now turns down the temperature of their wash compared with 4% prior to the campaign. However, its latest launch – Ariel Excel Gel – encourages consumers to turn their machines down to 15°C or, if machines don’t go that low, to a cool setting. The product is described as “a breakthrough, new-generation of washing detergent, which delivers outstanding cleaning even at temperatures as low as 15°C”.

Brand public relations manager for fabric and home care at P&G, Catherine Fairchild, says: “Our surveys of consumer habits and practices confirm people are washing at lower temperatures, and they are definitely becoming more aware of the energy they use in their homes. They understand that by turning the temperature down on their wash, they are positively impacting the environment, but also their energy bill. Lots of UK consumers have become more energy-conscious as a result of the Ariel campaigns and the work P&G has done with our external partners such as the Energy Saving Trust.” Meanwhile, Unilever laundry category manager Marie Scoble says last year was a good one for laundry with sales up 2.7% to just shy of £1.3bn, according to IRI figures for the 52 weeks ending November 30. It was an even better period for Unilever, whose Surf brand enjoyed growth of 27%. Scoble says Surf is particularly relevant for c-stores as it’s a value brand that offers users fantastic cleaning and fragrance. “Fragrance is a really big trend. A lot of consumers will think ‘all washing powders clean so I want one with a really nice fragrance’ which is why so many pick Surf,” she explains. In washing, ‘powders’ format is important. Actual powder is still most popular, accounting for 40% of sales; followed by tablets with 22%; liquids with 21%; and capsules accounting for 17% of sales. Scoble reports that concentrated liquid is the fastest-growing format and that’s good news for c-store retailers as packs take up less room on shelf. She says pack size is important as many c-store customers will be walking to and from the shop and won’t be able to carry large and heavy packs of powders and liquids. “Shoppers are most loyal to format first then brand,” she says. “Next is variant, which is why we suggest that retailers merchandise their shelves in this way. They need to stock the brands their customers want and they need to offer bio, non-bio and colour variants.”

She adds that people are shopping around more for deals and promotions: “Promotions are definitely relevant for c-stores and a single unit price is the preferred mechanic. Pricemarked packs are popular, too, for showing consumers that stores offer value.”

wash and grow

As well as washing powders the laundry category includes products such as fabric conditioners,

pre-washing treatments, ironing water and tumble dryer sheets. Scoble says: "Each retailer knows their catchment and will know what will sell in their store."

Finally, one product that's catching on fast with consumers is Colour Catcher, which aims to prevent colours running in your washing machine. Instead of colours from different clothes running into each other they are caught on the Colour Catcher sheet.

The product comes in a trial pack of five sheets for 99p, as well as 10s packs for £1.99 and 20s for £2.99.

Colour Catcher will be promoted in 2009 by sampling and money-off coupons.

Key trends

● Sales of all-purpose products are growing and they are offering an increasing range of benefits to meet consumers' needs for quick clean-ups

● Toilet care products are growing strongly thanks to heavy investment in new product development and advertising

● While liquids are the predominant format, spray products continue to show good growth in both multi-purpose and task-specific products

● There is a trend towards cleaning little and often among AB consumers, older people and those without children. It is these groups that are trading up to added-benefit products such as multi-purpose sprays and wipes

● Many multi-purpose products now offer the benefits of specialised products such as limescale removal or disinfecting and are cannibalising sales of the specialist sector

● Products that facilitate hands-off cleaning are driving growth in toilet care. These include in-bowl gels and blocks, wipes and tablets

● With a quarter of consumers concerned about germs, sales of bleach and disinfectant are holding their ground, despite their old-fashioned image and appealing mostly to older consumers

● Sales of wipes are stabilising, but there are continued launches in this sector, with both multi-purpose and task-specific wipes being added

to ranges.

Source: Mintel

● Sales of all-purpose products are growing and they are offering an increasing range of benefits to meet consumers' needs for quick clean-ups

● Toilet care products are growing strongly thanks to heavy investment in new product development and advertising

● While liquids are the predominant format, spray products continue to show good growth in both multi-purpose and task-specific products

● There is a trend towards cleaning little and often among AB consumers, older people and those without children. It is these groups that are trading up to added-benefit products such as multi-purpose sprays and wipes

● Many multi-purpose products now offer the benefits of specialised products such as limescale removal or disinfecting and are cannibalising sales of the specialist sector

● Products that facilitate hands-off cleaning are driving growth in toilet care. These include in-bowl gels and blocks, wipes and tablets

● With a quarter of consumers concerned about germs, sales of bleach and disinfectant are holding their ground, despite their old-fashioned image and appealing mostly to older consumers

● Sales of wipes are stabilising, but there are continued launches in this sector, with both multi-purpose and task-specific wipes being added

to ranges.

Source: Mintel

Smell that sell

The credit crunch is a concern for players in the air care (or air freshener) market because these are, after all, a non-essential purchase. This is why Ambi Pur has provided special value packs throughout the winter, offering 100% extra-free. Further promotions are expected through into the spring.

A key trend in air care is the popularity of seasonal fragrances, so Ambi Pur's latest launch is an updated spring collection range. There are two fragrances: spring orchard and spring meadow, both available in a 3volution Plug-in, a standard perfume plug-in and as a scented candle.

Spring orchard is described as "a collection of fragrances inspired by cut flowers", while spring meadow "combines luscious citrus, the freshness of morning dew and the purity of white flowers".

In addition, there are spring collection rim blocks, which are available in the complementary fragrances of blossoming flowers and fresh gardens.

The credit crunch is a concern for players in the air care (or air freshener) market because these are, after all, a non-essential purchase. This is why Ambi Pur has provided special value packs throughout the winter, offering 100% extra-free. Further promotions are expected through into the spring.

A key trend in air care is the popularity of seasonal fragrances, so Ambi Pur's latest launch is an updated spring collection range. There are two fragrances: spring orchard and spring meadow, both available in a 3volution Plug-in, a standard perfume plug-in and as a scented candle.

Spring orchard is described as "a collection of fragrances inspired by cut flowers", while spring meadow "combines luscious citrus, the freshness of morning dew and the purity of white flowers".

In addition, there are spring collection rim blocks, which are available in the complementary fragrances of blossoming flowers and fresh gardens.

Retailer's view

Gareth Moore,

Spar Llangoed, near Beaumaris, Anglesey

"We devote 2.25 metres with six shelves to household and laundry, plus we have a promotional end. At the moment, Spar has a great offer on Surf powder with 'two for £3' which is proving very popular. We also have Flash spray for £1, Persil Small & Mighty for £3 (usually £4.33) and Parazone bleach for £1. They are really good offers, so we can compete with the likes of Aldi and Lidl. We also have Spar-branded stuff - a washing powder for 99p and bleach for 49p-ish.

"My customers are not particularly brand loyal on household products; they'll buy any brand that's on offer. The category may not be as exciting as food, but it is quite colourful. And it's important, otherwise I wouldn't give it space. I reckon it accounts for about 10% of my trade."

Gareth Moore,

Spar Llangoed, near Beaumaris, Anglesey

"We devote 2.25 metres with six shelves to household and laundry, plus we have a promotional end. At the moment, Spar has a great offer on Surf powder with 'two for £3' which is proving very popular. We also have Flash spray for £1, Persil Small & Mighty for £3 (usually £4.33) and Parazone bleach for £1. They are really good offers, so we can compete with the likes of Aldi and Lidl. We also have Spar-branded stuff - a washing powder for 99p and bleach for 49p-ish.

"My customers are not particularly brand loyal on household products; they'll buy any brand that's on offer. The category may not be as exciting as food, but it is quite colourful. And it's important, otherwise I wouldn't give it space. I reckon it accounts for about 10% of my trade."

No comments yet