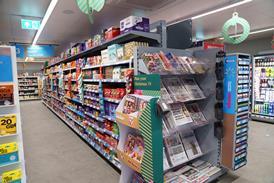

Bank card users up c-store visits, while rapid delivery trips dip

By Sarah Britton2023-06-29T12:08:00

Shoppers who pay by card are spending more in c-stores this year due to more frequent visits

ALREADY HAVE A REGISTERED USER ACCOUNT? PLEASE LOG IN HERE

To read the full story join the ConvenienceStore.co.uk community today!

Registration is quick and easy and provides access to:

- Unlimited ConvenienceStore.co.uk articles

- Our great range of newsletters

- Content you’ve saved for later via the ‘my library’ feature

And much more…

Related articles

More from News

Unlimited Access + Newsletters

Register today to gain unlimited access to articles and to receive our great range of email newsletters.