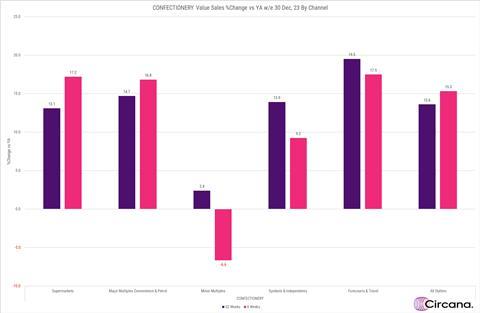

The latest analysis from Circana examines confectionery in convenience in terms of value sales and market share

Based on Circana’s Total Store read, food had a strong Christmas. Food sales in the four-week run up to the 30 December were up by 4.1% vs last year. Growth is price-driven with units just down last year. Growth has slowed in the latest four weeks versus the 52-week average performance as price increases lap with last year driving inflation down.

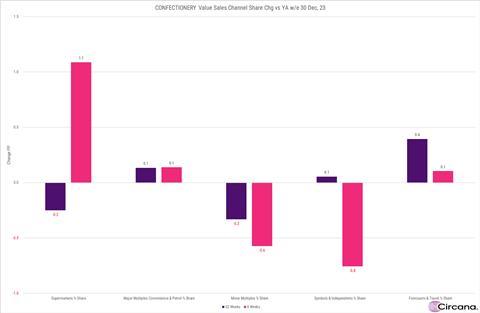

Confectionery had a phenomenal Christmas trading period with value sales up 15.3% in the four weeks to the 30 December, versus last year, with chocolate the main performance driver. Growth in the four-week accelerated over the 52W average (+13.6%), with volume sales marginally up on last year despite very high inflation driven by the continuing high cost of cocoa. Christmas is not traditionally a good trading period for convenience and especially symbols and independents, however, this Christmas looks to have been particularly poor for symbols and independents, with symbols and independents losing 0.8PP of confectionery value share despite growing value sales by 9.2% in the L4W vs LY.

Performance reflects the growing threat from major multiple grocer convenience. Major multiple grocer convenience increased share of confectionery by 0.1PP over the last four weeks, indicating that many shoppers still valued convenience but were attracted to cheaper prices available in major multiple grocer period over the Christmas run up.”

What’s next in confectionery?

While convenience’s share of sales in the confectionery market dipped in the run-up to Christmas, the seasonal cycle rolls on with St. Valentine’s Day and Easter on their way. Independent retailers have an opportunity to highlight last-minute purchases, particularly for 14 February, with bespoke in-store displays that flag up confectionery as well as other related categories. Easter hits a little earlier this year (31 March) so those caught out by the Easter Bunny’s arrival may need to visit their nearest convenience store. Brands are working to the ‘buy early, buy often’ ethos so Easter impulse lines are already in stores to tempt shoppers looking for a treat during a dark January.

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet