The latest analysis from Circana examines food to go in convenience in terms of value sales and market share

The Food to Go market, which in Circana’s market definition includes sandwiches and prepared fruit, is worth £1.4Bn annually.

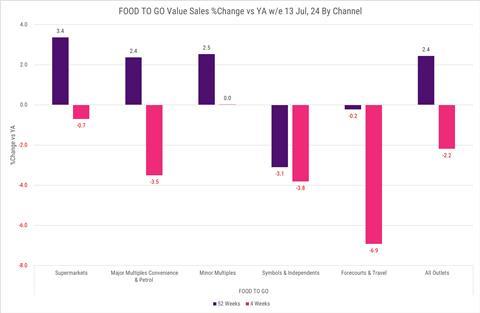

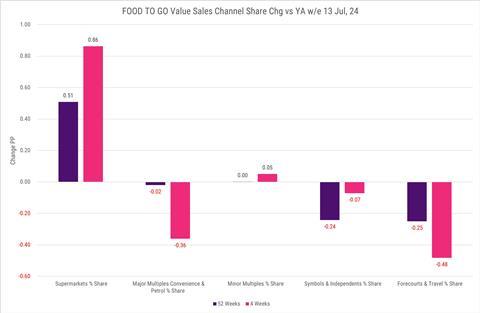

The market is dominated by the Major Multiple Grocer Channel which has 84% market share. The market is in growth up 2.4% in value sales in the latest 12 months (L12M) vs last year (LY), but growth is some way behind the market food growth which stands at 4.3% in the L12M vs LY. Food to go value sales have slipped into decline in the latest 4 weeks (L4W) vs LY, down 2.2%, well behind the market food performance which saw growth of 1.6%.

Food growth was boosted by beer and lager performance driven by the Euros which likely depressed food to go performance further.

Symbols and Independent stores hold just 4.5% of the food to go market and with value sales growth of -3.1% in the L12M vs LY, Symbol and independent stores have lost 0.24PP of value share in the L12M. Albeit performance in the L4W was still down on last year by 3.8%, value share performance did improve, with symbols and independents down just 0.07PP in the L4W vs LY.

Given its under-performance relative to the overall food sector, food to go isn’t a top growth opportunity for symbols and independents. However, as a crucial shopping mission, it holds significant importance, presenting a unique opportunity for differentiation that could be highly valuable.

What’s next for food to go?

While Circana doesn’t see huge growth in the food to go category, recent research by Lumina Intelligence tips it to be a key driver for growth in convenience. With back to school coming soon, there will be plenty of opportunity for the category to attract new customers with time-strapped parents looking for food to go options.

No comments yet