The latest analysis from Circana examines the wine category in convenience in terms of value sales and market share

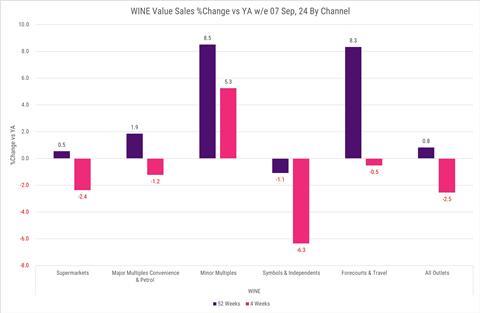

While wine category value sales remain on up last year (LY) in the latest 52 weeks (L52W) at +0.9%, the more recent trends have value sales down on last year, with value down -1.1% in the L13W and -3.1% in the L4W vs LY.

The wine category is performing marginally behind the wider beer, wines and spirits sector and well behind food in total, which by contrast remains 4% up on LY in the L52W. Price per litre has been steadily coming down in recent time periods, as price increases lap with LY, but the category looks to have impacted by cost-of-living pressure, with volumes failing to recover, down -4.6% in the L52W vs LY. As a consequence, the category has seen an increase in promotional investment over LY in recent time periods, but for now the volume trajectory has failed to recover.

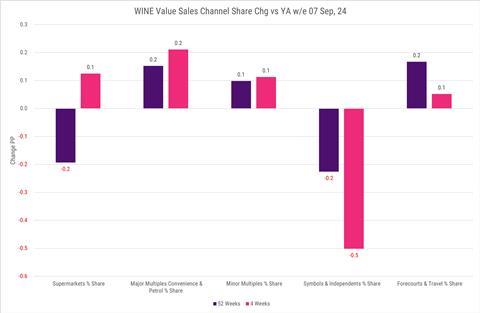

Wine volumes haven’t been helped by a relatively poor summer and don’t look to have been boosted by the European Football championship in the same way that beer has. The symbols and independent channel value share of the wine market is 11.9% but with value sales declining by -1.1% in the L52W and by -6.3% in the L4W vs LY, the channel is losing share of the wine market. However, there is a role for wine in the convenience channel with the Major Multiple Grocer Convenience channel gaining value share up +0.2 percentage points (PP) over the L52W vs LY. The forecourts and travel channel has also gained share, at +0.2PPs up vs LY in the L52W meaning that over the L52W supermarkets lost value share of the wine market. In most categories, supermarkets have been gaining value share from the convenience channel and notably from the symbols and independent channel.

As one of a few categories where the convenience channel looks to be winning from supermarkets, wine is an important market for symbols and independents to compete effectively.

What’s next for wine?

The countdown to the festive season is now on, and that’s typically peak wine selling time, with more parties, last-minute gifts and cozy nights in happening. While independents can’t compete with the multiples in terms of range, having a selection of wines at price points that invite trading up is key to building basket spend.

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet