The future political landscape may appear beyond everyone’s control, but c-stores can play a part in defining their fortunes over the coming year and capitalise on demand for convenience. Industry commentators and retailers forecast what’s in store for 2019

Issues at home remain a priority

James Lowman, Association of Convenience Stores chief executive:

“While much of the political world gets transfixed by Brexit, we need to be thinking about the Queen’s Speech that will probably follow the expiration of our Article 50 notice period on 29 March. Assuming it gets past 29 March, the government will want to set out a domestic policy agenda, and c-stores could find themselves front and centre.

Scotland is ahead of (or behind, depending on your perspective) the rest of the UK in developing detailed plans for restricting the siting of high fat, salt and sugar products, and in devising a deposit return scheme. We have to expect measures like this to be included in the UK government’s 2019 work plan, and our job will be to explain the practical impacts of these policies on local shops.

One of the biggest issues we’ll be focused on in 2019 probably won’t actually lead to any change for our sector until 2021. This is the review of the remit and role of the Low Pay Commission, as the government works out what the right approach to statutory minimum pay rates should be.

If wage rates are the top financial issue facing retailers, crime is the most important operational challenge. 2019 will be a big year for us in pressing home the recommendations from the Centre for Social Justice’s Desperate for a Fix report, calling for more effective police response, a higher priority for shop crime from Police & Crime Commissioners, and better rehabilitation for drug-addicted shop thieves. Look out for lots more campaigning on this issue.

Moving out of the Westminster bubble and into the villages and housing estates which are our sector’s heartland, I remain convinced that c-stores are becoming more relevant to the consumer and the community. Our sector will grow and change in 2019, and be yet stronger still in 12 months’ time.”

Food to go needs to evolve

Martin Swadling, Londis brand director:

“While there are sure to be lots of challenges in 2019 there will still be many opportunities for increased sales and profit. Keeping up to date with the latest trends and being best placed to maximise sales will be key to any successful retailer.

Food to go is a vital part of any successful convenience offer these days, with a great coffee offer still the key driver. However, it’s not enough simply to put the offer in store and then expect it to be successful. Retailers should have a plan to drive sales, and loyalty fobs are a great way of doing this.

Hot food is a must and for those looking to do something bigger: concessions such as Stone Willy’s or Subway can make your store a real destination. Dessert bars offer margins of more than 70% and can be a real profit-making opportunity this coming year.

Free-from and protein will continue to grow, and following on from the ‘healthier’ trend retailers should look to vegetarian and vegan foods as a source of sales. As with all new trends, using POS to let your customers know you have the range is key to success.

Craft gins and premium spirits are another area to grow. All good c-stores should be carrying a range and using back-lit fixtures is a great way to make them stand out. It’s all about trying something new so keeping an eye out for lines that have a real USP will help you stay one step ahead of the competition.”

Be smart about the competition

Mike Hollis, Costcutter Supermarkets Group retail director:

“The big challenge for independents is to stay relevant by turning the increasingly competitive trading environment into a positive.

Convenience retailers stand in a strong position in the age of online shopping. While online shopping is very much price led, convenience retail is all about spontaneity and, to a degree, price is less important because it’s all about accessibility. Shoppers accept they have to pay a little more for the privilege of shopping on their doorstep.

The expansion of the discounters is a concern. Retailers need to look at how they can capitalise on the presence of the likes of Aldi and Lidl - for example, neither stock regular branded ranges or local produce, so independents can fill these gaps.

Own brand will be one of the most important categories. Recent research has revealed that 50% of all products in today’s shopping baskets are own brand, so it’s vital that the convenience sector fulfils this need. Our new Co-op own brand range means our retailers are now better placed to respond to key shopper missions, especially when it comes to the all-important food-to-go category.

We are all shopping more frequently, so fresh food is key, whether that’s across food to go or food for tonight and we are all much more conscious of food waste. As a sector, we need to be looking at smaller pack sizes and availability.

Retailers need to be smart and use all the data available to them. By simply standing on the roof of their store and viewing the type of properties and observing the habits of the residents in terms of the frequency and timing of their visits, they can tailor their offering accordingly.”

Shoppers will focus on plastic

Jill Livesey, HIM managing director:

“The convenience channel is pivotal to the food and grocery sector and this is certainly not set to change in 2019. However, there are trends that will impact the way retailers, suppliers and shoppers behave.

Plastic reduction will be one of biggest. 2019 will bring a shopper-focused approach to the ‘plastic problem’. Retailers will be thinking about how to incentivise shoppers to be more mindful in their consumption habits. They will need to understand which categories are most at risk and which are doing well in the eyes of the shopper. This ties into a wider trend for responsible retail.

In 2018 we have seen a rise in living wage, the importance of allergen information, and ‘giving brands’ come to the forefront. These factors are contributing to the changing nature of what ‘good service’ means.

Shopper expectations are rising in line with technology. Self-service checkouts, e-shelving and advances in delivery have all made waves in other industries, but have yet to make a significant impact in convenience. Next year might not be the year that shop assistants go virtual, but there will be more pressure for c-stores to pay more attention to their e-commerce strategy.

Social media shopping has yet to hit FMCG in the same way we have seen in other industries, but Instagram is affecting more consumer decisions than ever through personalised advertising and ‘swipe up to shop’ capability. As consumers demand more personalisation in their shopping experience, it is more important than ever to understand your shopper and how to capitalise on this vast opportunity for convenience.

We have entered an era where experiences and opinions are traded as a form of currency. Creating an exceptional shopping experience will ensure that bricks and mortar stores keep their edge over online.”

Stay relevant to stay successful

Steve Leach, Nisa Retail sales director:

“Over the coming years there are forecast to be clear winners and losers in the UK grocery market. The winners are likely to be the discounters, online retailers and, importantly, the convenience sector.

The reason for likely growth in the convenience sector is driven by a changing consumer profile and shopper mission. Consumers are shopping locally far more, often influenced by a number of things including controlled basket spend, reduced wastage and, in an increasingly busy age, a need to pick up a last-minute meal solution. There is also a sense that with a more sophisticated convenience proposition at their disposal, consumers are making the decision to shop with local businesses.

The big challenge comes from the change in shopper mission. There is an increasing onus on fresh produce, healthy protein - often plant based - and a reduction in the importance of alcohol and tobacco as the new generation adopt healthier lifestyles.

The problem is that the former are areas convenience retailers have historically struggled to compete in, whereby the latter have been the life blood of those stores.

Nisa partners now have the advantage of being able to stock Co-op own brand, which opens the door to a wider range of quality fresh lines with strong ethical sourcing credentials and a trusted brand reputation.

Perhaps a bigger challenge to convenience than even the discounters, though, is the rise of online and we need to explore how we can help independent retailers in this respect.

In a society where making a purchase online through a website or app is almost second nature, we need to ensure that the local, community retailer remains relevant by embracing technologies and offering services that allow convenience retailers to either retail online themselves or to act as a delivery point for other online sales, through the likes of Amazon Lockers and so on.”

Differentiate to stay a step ahead

Dominic Hall, National Guild of Spar chairman:

“Convenience retailers have never faced more challenging times. They are under pressure as they grapple to differentiate their businesses, a necessity if they are to satisfy the increasingly demanding needs of today’s savvy consumer.

This means convenience retailers need to invest in a mix of diverse goods and services to create a point of difference. They also need to look into more convenient options, developing an offer tailored to their shoppers.

Convenience retail is moving quickly. Being a member of a symbol group means independent convenience store owners have the support they need to be agile enough to respond to market changes quickly. They have support from their wholesaler, who should be offering them the most relevant product range, the cheapest prices, as well as business support, availability and regular, convenient deliveries.”

Concentrate on convenience

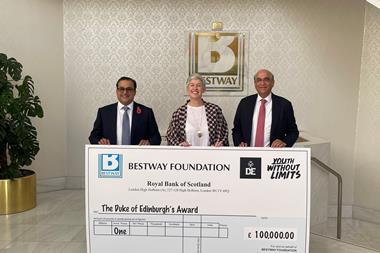

Dawood Pervez, managing director, Bestway Wholesale:

“All market trends for 2019 point towards convenience, as consumers become more time-strapped and seek convenient solutions to eating out of home on a budget.

Retailers also continue to seek convenience with increasing numbers of our customers moving more towards online and delivered wholesale, which is why we continue to adapt our proposition to reflect this, with a new ordering app, refreshed website and a depot hub project.

Consumers are visiting retail stores more often and independent retailers need to stock a range to meet consumers’ needs at different day parts - products that work hard for them and minimise the amount of cash tied up in stock.

Serving high-quality coffee, food to go and food for tonight, including a wide range of chilled and fresh are key to meeting this demand. In fact, Bestway is 5.8% in growth in fresh year on year and is doubling the size of its chilled distribution centre.

Track and trace generates some significant challenges in selling tobacco through the supply chain within wholesale in 2019, but there may be some upsides in reducing illicit trade. However we would reassure retailers that once they’ve registered, the actual tracking will sit with us as wholesalers.

I think rents and rates will fall, ensuring the entrepreneur can come back onto the high street, so we foresee a positive year ahead for independent retail.”

Let’s get people to shop local

Jerry Tweney, Prestbury Village Stores, Cheltenham:

“I think the convenience retail landscape is very healthy. It’s great to see people like Andrew Thornton making headlines regarding plastic-free, and there are adverts on the television telling people to support local retailers. On our Facebook page I’ve seen loads of shares of images showing a blackboard saying ‘Shop local’. If you understand your market, there’s great opportunity.

Cost is without a doubt the biggest threat in 2019. Our electricity bill is high, our rates are high, rent is high - our cost base is high before we open our doors, and we have a rise coming in the wages in April.

You can only cut costs to a certain level and then there is no more saving to be made. The better way of looking at it is what else can we sell and how can we grow our sales.

We’ve got to get people to shop local. Service is the difference between us succeeding or failing. We can’t compete with the multiples on price or range, but we can give exceptional service - walk their shopping across the road to the car park, deliver at the drop of a hat. Review your range and see if it is ready for 2019.

Don’t be afraid to try different things. Analyse what you sell per square foot and what return you are getting. And tailor your range to your customer.

Local food is big and that will continue to grow. The customers love it. Look at the quick wins you can make and then at the bigger picture and what’s working for you.”

Services and standout are key

Paul Gardner, Convenience Retailer of the Year, Budgens Islington, London:

“Costs are ever increasing. Whether it’s your insurance premium or business rates, everything is going up. In 2019 we’ll have to look at what variable costs we can control and bring down.

I’ve got concerns about online shopping and the discounters, but they aren’t at the top of my list as I really feel that convenience shopping is here to stay. We’ve got to find our USPs to make people want to come to the store and enjoy the experience, because it’s not just another faceless multiple, but has more of a community feel and interesting new products that they aren’t going to get in the multiples. We need to bring the excitement and interest back into food shopping.

2019 will see retailers evolving their businesses. As an example, we refitted Islington in the summer of 2017 and we’ll be putting in a post office at the beginning of next year.

It’s about points of difference, coupled with services. Let’s look at taking advantage of online sales by offering a service - a post office, Amazon Lockers, CollectPlus, or UPS - that’s going to bring footfall.

We have a number of concessions: a butchery and a sushi counter. That’s not going to work for everybody, but retailers have got to find their own niches that are going to drag people in and encourage them to spend that extra bit of money.

I think there’s going to be more consolidation in 2019. Some of the smaller wholesalers are going to have to be bought out or partner with someone else. Customers are demanding better prices, and with our costs increasing we’re demanding better margins. You’re not going to get that from a small wholesaler. C-stores are going to be shopping around.

It is tough and going to get tougher, but now is the time to start looking at how you’re going to be there in five years and trading well.”

The pressure is on margins

Donna and Bruce Morgan, Brownies Best-one, Biggar:

“The biggest challenge we see over the next year is trying to maintain or hopefully improve margins while having to absorb increasing costs. Increasing use of technology and finding more efficient ways of working can help alleviate some of this; we have already made substantial savings by investing in more energy-efficient equipment.

The same old threats are still there: the rise of the multiples and deep discounters as well as the push from the supermarkets to get into the convenience sector. Brexit is another big unknown.

Security is becoming more of a concern - a lot of small bank branches are closing and as we have a Post Office the amount of cash coming in has increased significantly. The lack of police presence is exacerbating the issue as our local police station shut last year.

There are plenty opportunities, however. In Scotland, Minimum Unit Pricing for alcohol has levelled the playing field - hopefully the rest of the UK will follow suit.”

No comments yet