The convenience sector has had to work hard during the coronavirus pandemic. When panic buying in March happened and the supermarkets were found wanting, the public turned to a resource that was on its doorstep all along to ensure they had enough toilet roll, pasta and fresh meat.

Retailers were suddenly faced with an influx of new customers that they had make sure were safe, all while adhering to social distancing in smaller spaces than the multiple retail outlets and ensuring that stock levels were maintained.

The sector more than survived during this period, in fact it thrived. According to Nielsen data, share of sales in convenience reached a peak of 30% in the four weeks to 18 April, with the average spend per visit increasing 35%. Even though this spectacular growth slowed, the latest data from Nielsen showed that sales grew by 17% in the four weeks to 13 June, highlighting that shopper habits may have been created during lockdown.

But what happens afterwards? Social distancing is down to one metre plus and most other shops are now open so the sector has lost some of its advantage. Will these customers drift back to the multiples for their shopping now that queues are going to be shorter? Or will they stay loyal?

We spoke to retailers who had a plan for this situation and are aiming to retain as much of this new business as possible.

Kash Khera, chief operations officer of Simply Fresh, explains how footfall in member stores has tailed off from the peak of lockdown but it’s still up year-on-year.

“Some of our retailers are still up as much as 100% turnover wise but then we’ve seen it level out to between 30% and 50% for most.

“Before this happened, if someone said your sales would be up 20% year-on-year, you would have bitten their hand off. How much money would a retailer have had to invest to make that increase? A lot of businesses were either declining or standing still, there was a little bit of growth across the sector but that was all linked to store investment or opening new businesses.”

But he is optimistic about the future for the channel. “There’s still a massive opportunity for independent retailers. The pandemic hasn’t gone away, it’s eased but there could be regional lockdowns or a second spike. For retailers that hadn’t considered delivery, they may have the headspace to do so now that things have calmed down a bit.”

Amish Shingadia of Londis Caterways in Horsham, West Sussex believes there’s going to be a dip in footfall as shoppers brave a return to the multiple retailers.

“You are going to see a massive decline in stores but we’re aiming to retain 20% of the growth we saw during lockdown through changing shopper habits. There’s a lot more customer awareness of our offering now than before.

He says increasing an offering is the way to keep those customers. “You need to assess what else can you put inside your business to add to it as customer service and ranging only gets you so far. More people vaping is potentially an opportunity.”

Active in the community

Kash stresses that the most important thing retailers can do to keep customers is to focus on what brought them to the table in the first place.

“We’ve been telling our retailers and trying to coach them on being active in the community, particularly on social media as a lot of people are still isolating. That’s a great way for letting people know you’re still here and that you’re there to be used.”

He said that community outreach has a dual purpose – connecting with customers and reassuring them that stores are safe to visit.

“Messaging is important. For us, there’s been a lot of communication to customers about keeping the store clean and colleagues safe. Sometimes you have to be subtle about it and sometimes you have to hit it with a sledgehammer so customers feel reassured that the shop environment is clean and safe. It’s another way of reminding the customers that we were there for the community and we continue to be there.”

Fighting the price war

Kash says that while a looming price war is a concern, retailers should focus on their strengths for now. “You’ve got to be concerned at the prospect of a price war but independents need to focus on what they’re good at - talking to the community and being able to pivot quickly to match trends.

“You have to find a way to tackle a price war using your strengths which includes being involved in the community, tailoring your range to your community whether that’s local products, brands and suppliers or if that’s within categories by having better products like restaurant quality meals, especially if there will be fewer restaurants and pubs open.

“We’re a while away from it becoming just about prices, at the moment it’s about making sure we’re taking advantage of the enhanced footfall. You will have a lot of customers who have never been in your store before so are you engaging with those customers and showing the best of yourselves?”

He believes retailers need to be forensic with how they assess their own business. “Look at every aspect of the business. Are staff members trained to communicate the message you want to convey? Do they need a break or a holiday after the past few months to come back refreshed? Does the store’s layout need changing? Could you use the additional money made over the past three months to invest in upgrading the store?

Growing sustainably

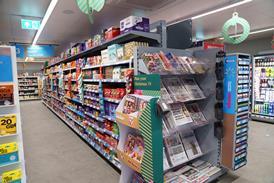

Amrit Pahal of Nisa in Walsall has invested in his business to help show off the store in the best light with a view to retaining customers. His sales growth in the early weeks of the lockdown were spectacular and while they’ve dropped, they’re still nothing to be sneezed at. “We increased more than 100% during the peak of the pandemic and now we’re rocking 80% and I don’t see why we can’t keep it at that.

“I’ve spent six figures on the store overall. Improved chilled and beers, wines and spirits. Added a shelf to expand the range. We’ve cleaned up our merchandising

“The idea behind the refit has been to retain customers during this whole period. We’ve been stepping up our game as soon as we possibly can to keep these new customers especially as supermarkets are coming back at us hard with promotions.”

Kash warns that retailers shouldn’t rush to add new lines to their store that may not be sustainable post-lockdown. “The danger is that retailers add lots of new products but as the tide starts to go out a little bit, how are retailers going to maintain the standards and manage those ranges. This is particularly important in persishable products, if you had the footfall to justify getting certain products in but then footfall drops, do you delist that product and risk disappointing customer and losing the whole basket. Or do you top-up and make no margin. Or accept the loss on the wastage but keep the customer.”

What are your plans for keeping customers post-lockdown? Let us know at aidan.fortune@wrbm.com

No comments yet