The latest analysis from Circana examines energy drinks in convenience in terms of value sales and market share.

Total market food value sales growth continues to slow down as price inflation slows. Volume is picking up in food, notably in ambient grocery, chilled and frozen, but volume shows no signs of recovery in impulse as yet. With Impulse prices staying higher for longer, value sales growth slowdown is less than in other categories and the impulse sector continues to grow share of total store.

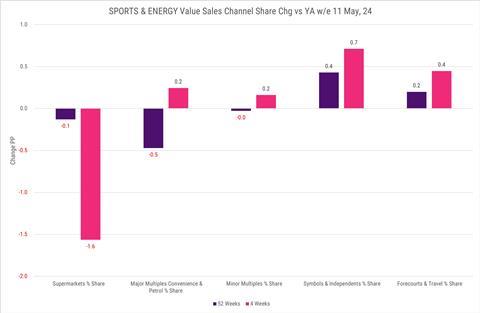

Within the impulse sector, the symbol and independent channel is losing value share in more recent time periods, as a result of significant unit share loss, following a similar pattern as food in total.

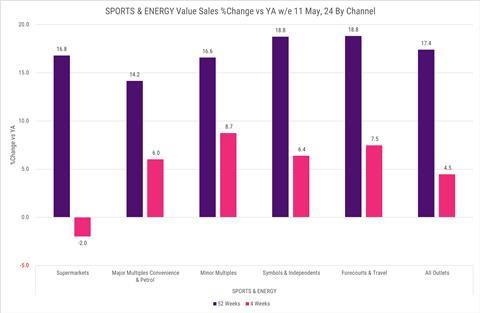

Within the impulse channel, sports and energy drinks are seeing strong growth, with value sales up 17.4% in the last 12 months vs last year, which sees sports and energy drinks growing share of Impulse. Growth does look to be slowing, with sales only up 4.6% in the L4W vs LY. Value sales growth is slowing within the symbols and independent sector but is still growing ahead of the market.

As a result the symbols and independent channel is growing value share of the sports and energy drinks market. Symbols and independents have a 37.9% share of the sports and energy drinks market, growing share by 0.4PP in the L12M and strongly by 0.7PP in the L4W vs LY with supermarkets the big share losers.

With a 37.9% share of the sports and energy drink market versus just a 18.2% share of impulse for symbols and independents, the strong sector performance is helping to boost the overall performance of the channel.

What’s next for Sports and Energy Drinks?

Summer is typically strong for sports and energy drinks as the warm weather improves but plenty of NPD from the major players should keep interest running high among consumers. Brands have been working hard on activation in the convenience channel to support retailers and given the growth detailed above, it’s working. The recent Britvic Soft Drinks Report also highlighted how both sports and energy are on the rise, and that retailers should look to sugar-free variants to attract new shoppers to the category.

![WG-4003[58]](https://d2dyh47stel7w4.cloudfront.net/Pictures/274x183/4/5/1/353451_wg400358_6083.jpg)

No comments yet