1. Bread is proving resilient to the cost-of-living crisis

2. Speciality bread is surging ahead

3. White bread is responsible for over half of pre-packaged bread sales

4. Crumpets and other trad breakfast items are growing 0.9%

5. Premiumisation trend sees brioche flourish

6. Sweet treats are a recession must-stock (at the right price)

1. Bread is proving resilient to the cost-of-living crisis

As the economic gloom deepens, retailers can take a welcome crumb of comfort from the fact that shoppers still need to buy their daily bread. And if they’ve run out, the local c-store is their first stop for topping up.

“It’s just one of the main essentials people come in for: bread, milk and eggs,” says Jaz Ali, who owns a Premier store in Falkirk. “Everybody needs a loaf of bread!”

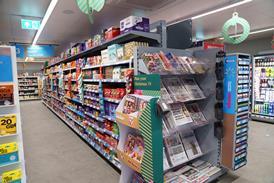

He keeps it front and centre in store to maintain keen sales. “In my store customers walk in and immediately see one aisle of rolls, bread and cakes. It creates a fresh look for the shop and just catches people’s eye. They walk in and think – ’Yep, I need to buy bread.’”

Demand may be daily, but the current climate is affecting what carbs shoppers are choosing to seek out. “Research undertaken earlier this year by Baker & Baker on the impact of the cost-of-living crisis showed that four in five shoppers had altered their spending decisions and priorities in the last year,” says Baker & Baker CEO John Lindsay. “[However] the cost-of-living crisis isn’t affecting everyone equally, and it’s clear that inflation and rising costs affect lower income families disproportionately. Bakery lines can play an important part with relatively accessible price points – offering a well-earned affordable treat.”

Jaz keeps value high on the agenda with Warburtons PMPs and always making sure he stocks Hovis at a good price. Yet, some consumers are still willing to pay a premium for upmarket bread too. Liam Cross, manager of Thatcher’s Spar in Kings Lynn, is supplied by two local bakeries which can command a premium for high-quality loaves.

“People know the bakeries and like the local angle,” he says. “And with bread – if they need it, they need it. Some of the bread from our local bakery might be up to a pound more than what they’d pay for Hovis or Warburton – but customers know what they like and are happy to pay it.”

2. Speciality bread is surging ahead

Is aspirational bread the new craft beer? For c-stores with the right demographic, speciality bread could win sales from the kind of affluent shoppers whose heads are turned by an upmarket IPA.

“Bakery has recently undergone the sort of transformation that the brewing industry experienced ten years ago in the craft beer revolution,” says Andy Smith, retail sales manager at Brioche Pasquier.

“There are of course still big bakers and dominant brands but the idea of craft has been re-introduced into the industry, with artisan bakers at the independent end of the market delivering sourdough, seeded, rye and numerous other loaves that are attracting the attention of consumers and putting the pressure on the large bakeries to follow suit.”

This trend is borne out by this year’s sales figures, as Phil Carratt, head of marketing and strategy at Country Choice suggests.

“Speciality bread saw a Q1 2023 resurgence as penetration and frequency grew and consumers looked towards more in-home treat occasions [Kantar],” he says.

“Loaves and rolls remain the key sub-categories, but baguettes are also an area to watch as WFH consumers choose an OOH lunch [ibid].”

For stores looking to dip their toe into posh pain, sourdough could be a good start. Enthusiasts who were sharing sourdough starters in lockdown, and now don’t have time to bake, might well be up to buy it out.

“Sourdough is the ‘go to’ product in the speciality bread category and it is likely that sourdough mixes will become more readily available in time,” says Carratt.

“Sourdough and rye combinations are also growing in popularity.”

3. White bread is responsible for over half of pre-packaged bread sales

But before retailers splash out on sourdough it’s vital to get the basics right. Like making sure you’re making the white choice.

“Traditional sliced loaves remain a key staple for the vast majority of households, due to their versatility and convenience – particularly in the morning when time is limited,” says Mark Frossell, senior national account manager at St Pierre Groupe, which owns the Baker Street brand. “Apart from the continued success of sourdough, many consumers are making the switch back to sliced white bread.

In fact, sales of white bread currently account for over 55% of pre-packaged bread units sold (Nielsen).

Alistair Gaunt, commercial director at Hovis, says: “Given the current economic climate, many shoppers are buying fewer different types of bread for their households and are increasingly moving towards pre-packaged white bread, which is most likely to satisfy the needs of multiple people [Nielsen]. It is therefore clearly important for retailers to stock white bread as it is a potential “crowd-pleaser” for everyone in the household.”

4. Crumpets and other traditional breakfast items are growing 0.9%

The popularity of basics also extends to retailers’ in-store bakery offer.

Richard Inglis, owner of three stores in Southampton, says that in his fixture, plain croissants win every time. “A standard croissant is most definitely our best-selling line,” he says. “I sold nearly 4,000 plain croissants across the three stores in 10 weeks. Interestingly enough, they outsold my pain aux chocolat by about a rate of two to one.”

“Traditional” breakfast items (like crumpets and English muffins) grew +0.9% in units over the latest year, notes Hovis’ Gaunt, citing Nielsen data. He claims that Hovis is well-placed to help retailers respond to this trend with products such as Hovis Bakers Since 1886 Crumpets and English muffins (with Barber’s Farmhouse Cheddar).

The trend towards traditional fodder may also be fuelling a surge in the ‘Toastie’ bread format at all three of Richard’s Southampton stores. He says that over the last ten weeks sales of the format have been double those of a standard medium loaf.

“That’s quite a significant figure,” says Richard. “And it’s not just in Warburtons – it’s also reflected in our Co-op bread too. It could be that people see thicker bread as a better value option.”

5. Premiumisation trend sees brioche flourish

As with other categories, bakery is witnessing the lipstick effect, with consumers spending more on little upgrades. ”The move towards premiumisation shows no sign of slowing and quality brands like St Pierre give consumers an opportunity to ‘trade up’ and elevate everyday meals, such as gourmet burgers, hot dogs, and French toast,” says Josh Corrigan, customer development director, UK at St Pierre Groupe.

”Convenience retailers’ customers are increasingly looking for products that deliver simple indulgence. Stores can cater for this demand by stocking ranges that ‘upgrade’ their bakery offerings from traditional staples to something more premium. Brioche is one key way to do this, and St Pierre’s bestselling brioche rolls and buns range is an ideal base for enhancing burger and hot dog recipes.”

With the addition of St Pierre Brioche Burger Buns (four pack), the St Pierre brand now has four brioche bun and hot dog roll products featuring in the Top 12 value rankings. The St Pierre Brioche Buns (six pack), St Pierre Brioche Hot Dog Rolls and St Pierre Seeded Brioche Burger Buns (four pack) are performing well with value sales up 40%, 71% and 212% in the last year (Nielsen).

6. Sweet treats are a recession must-stock (at the right price)

“Despite the current inflationary challenges consumers do want to treat themselves and choose little luxuries,” says Carratt.

“In the doughnut category consumers expect to see premium options and are willing to pay more for them. Sales of indulgent items actually tend to grow during times of hardship, and they don’t need to break the bank.”

Lindsay also sees the value-for-money treat potential of sweet bakery standards like doughnuts and muffins.

“With a continued shopper focus on cost and price, we expect the core of in-store bakery such as doughnuts and muffins will continue to dominate, and will represent the primary growth categories,” he says.

“We don’t foresee any immediate, seismic shifts in the market. In-store bakery and bakery in general continues to show resilience and will continue to be a vitally important part of the retail/consumer mix.”

To meet this indulgent market Baker & Baker is launching a new Cadbury Dairy Milk Chocolate & Orange flavour for its fresh Cadbury cookies in-store bakery range.

So, cheap and sweet thrills can help propel the profits in bakery. Yet Liam says that he’d like more support from suppliers in keeping prices down.

“Right now for us the value cakes, including own-label, are overtaking the bigger brands,” he says. “We don’t seem to be able to get a decent price on the likes of Mr Kipling – and there’s only so much people will pay for a pack. This is a problem when people can go to a local bakery and get these kind of items cheaper.”

Chaz Chahal has also found that customers at his Costcutter store in Marlpool are happy to buy unbranded cake. “We’ve doubled sales of cake - we do less branded ones and more that the cash and carry has,” he explains. “We sell tonnes of mis-shapes. You have to be cute with your range and offer something different that they aren’t going to get elsewhere.”

No comments yet